Financial Inclusion in the Digital Age Report_March 2018

The report on Financial Inclusion in the Digital Age was published in March 2018. It has been co-authored by Anju Patwardhan, Managing Director at CreditEase FinTech Investment Fund and 2016 Fulbright Fellow at Stanford University; Kai Schmitz, Investment Lead for the Global FinTech Investment Group of IFC; and Kenneth Singleton, Adams Distinguished Professor of Management at Stanford Graduate School of Business.

Over two billion unbanked adults in the world, representing 38 percent of all adults globally, do not have access to basic financial services and another 57 percent have basic accounts but do not have access to a full range of services that include diversified savings and investments, low-cost payments systems, insurance, or credit. Financial Inclusion in the Digital Age explores some of the central frictions that prevent greater financial inclusion and financial well-being and associated technological innovations that are fostering creative new approaches to mitigating these frictions for individuals and small businesses globally.

Today, FinTech companies are making significant progress in promoting financial inclusion through innovative business models, products and increased use of emerging technologies such as digital identity, Internet of Things (IoT), Artificial Intelligence (AI) and machine learning.

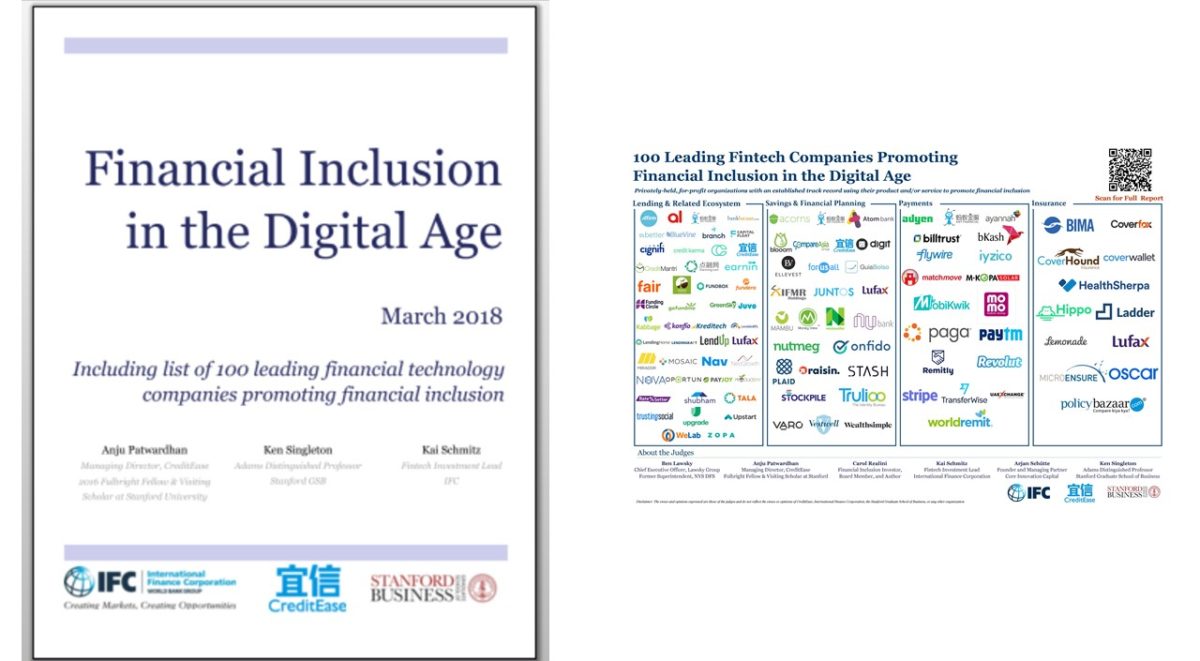

The report includes a list of Top 100 FinTech companies globally that are supporting “Financial Inclusion in the Digital Age” across four main verticals of impact: payments, lending and related ecosystems, savings and financial planning, and insurance. These companies are mission-driven but are also focused on providing attractive risk-adjusted returns to their investors.

The innovations and models outlined in this report highlight different solutions to three common core problems that limit financial inclusion: access to financial services, product-market fit, and affordability. The report calls on concerted efforts from multiple players: entrepreneurs, regulators, investors, policymakers, large incumbents, and consumers, to sustain the efforts of the growing private sector to improve financial inclusion.